The avoidance of taxes is the only intellectual pursuit that carries any reward.

John Maynard Keynes

Using ownership (of securities, instruments, or financial claims) to transfer wealth? What are those worth for tax purposes? Quid Valorem has extensive experience and expertise in proper valuation analyses for tax purposes that spans the scenarios likely to be part of any client’s gift and estate tax needs.

Planning, then Filing

Good fortune is what happens when opportunity meets with planning.

Thomas Edison

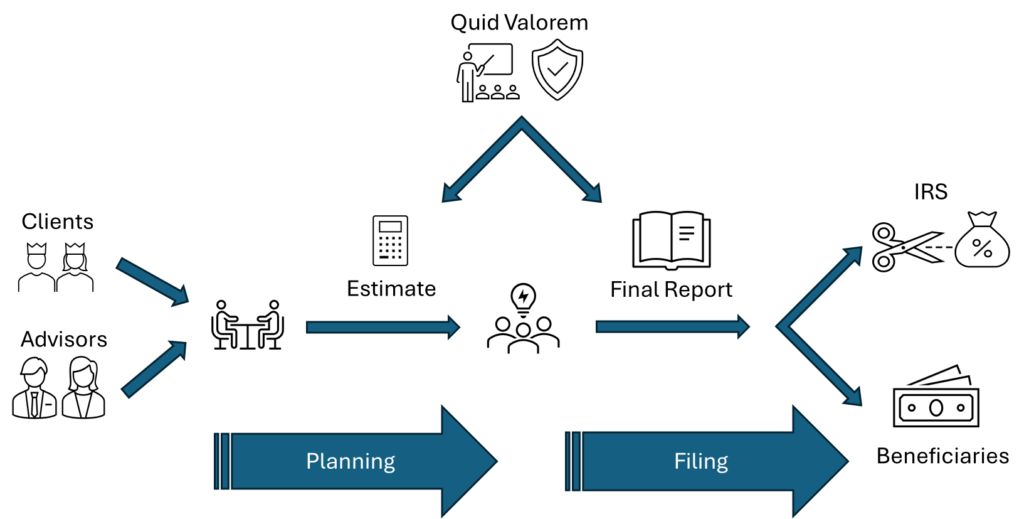

Quid Valorem understands that planning is part of the process of preparing to file gift (and, if able to be anticipated in advance, estate) tax returns. That planning, in turn, requires useful estimates of the value of investments. Engaging Quid Valorem early in the planning process allows more time to adjust plans for the impact of closely-held investment valuations.

The process might look something like this:

Quid Valorem can prepare draft analyses, starting from limited scope estimated ranges of value just for planning purposes. After planning is done, Quid Valorem supports the actual gift or estate tax returns with final, signed “comprehensive” reports with unrestricted scope opinions of value needed for filing purposes.

Valuing What? By What Rules?

The IRS acknowledges: “Many people pay more federal … tax than necessary because they misunderstand tax laws and fail to keep good records.”1

Investment rights and terms are only limited by investors’ imaginations. Many a valuation for gift and estate tax purposes has been undone not by poor financial valuation (yet those happen often, too) but by poor understanding of what was to be valued. Only after understanding the what can Quid Valorem value the investment.

Quid Valorem also understands that–to be useful for gift and estate tax purposes–valuations have to consider the factors required by the IRS as well as the factors that affect value in the real world (even if they are not analyzed the same way). Valuations for gift and estate purposes face the reality of IRS revenue rulings and Tax Court rulings for which the rest of the world has little concern or awareness2.

Investment Types

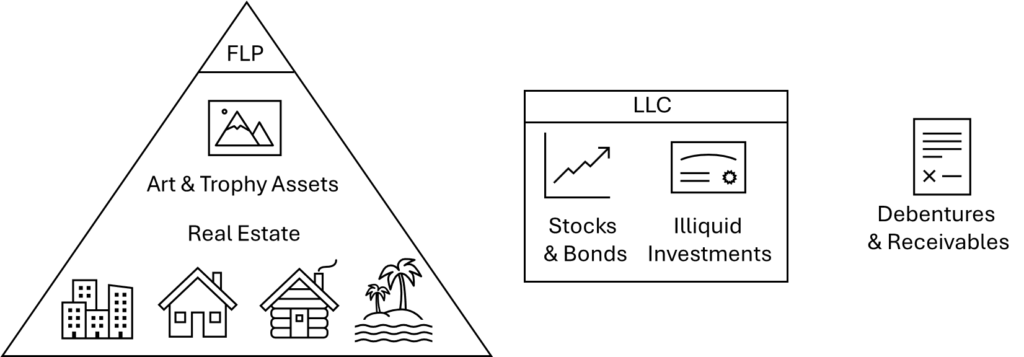

Quid Valorem’s experience with gift and estate situations ranges from holding entities (“FLPs” and “LLCs” with passive investments in all types of asset classes, from stocks and bonds to real estate to private equity and other illiquid alternative or “trophy” assets) to various securities (common, preferred, and other forms of equity participation). Quid Valorem’s experience extends to debentures and highly structured payment streams and contingent obligation receivables.

Just some examples of situations include:

Quid Valorem’s experience and expertise in proper valuation analyses for tax purposes spans the scenarios likely to be part of any client’s gift and estate tax needs. Turn to Quid Valorem to address your valuation needs.

- See: The Difference Between Tax Avoidance and Tax Evasion – IRS (https://apps.irs.gov/app/understandingTaxes/whys/thm01/les03/media/ws_ans_thm01_les03.pdf) ↩︎

- For example, Revenue Ruling 59-60 (https://www.govinfo.gov/content/pkg/GOVPUB-T22-aeceb42446d0516ef9c5306afe947a73/pdf/GOVPUB-T22-aeceb42446d0516ef9c5306afe947a73-1.pdf, page numbers 237-244), the principal IRS rule governing closely-held investment interest valuations for gift and estate tax purposes, does not feature, nor is referenced, in any contemporary finance or investments textbook outside of valuations for tax purposes, nor is it referenced in the body of knowledge of leading investment analysis credentials, such as the CFA Candidate Body of Knowledge (https://www.cfainstitute.org/en/programs/cfa/curriculum/cbok). ↩︎