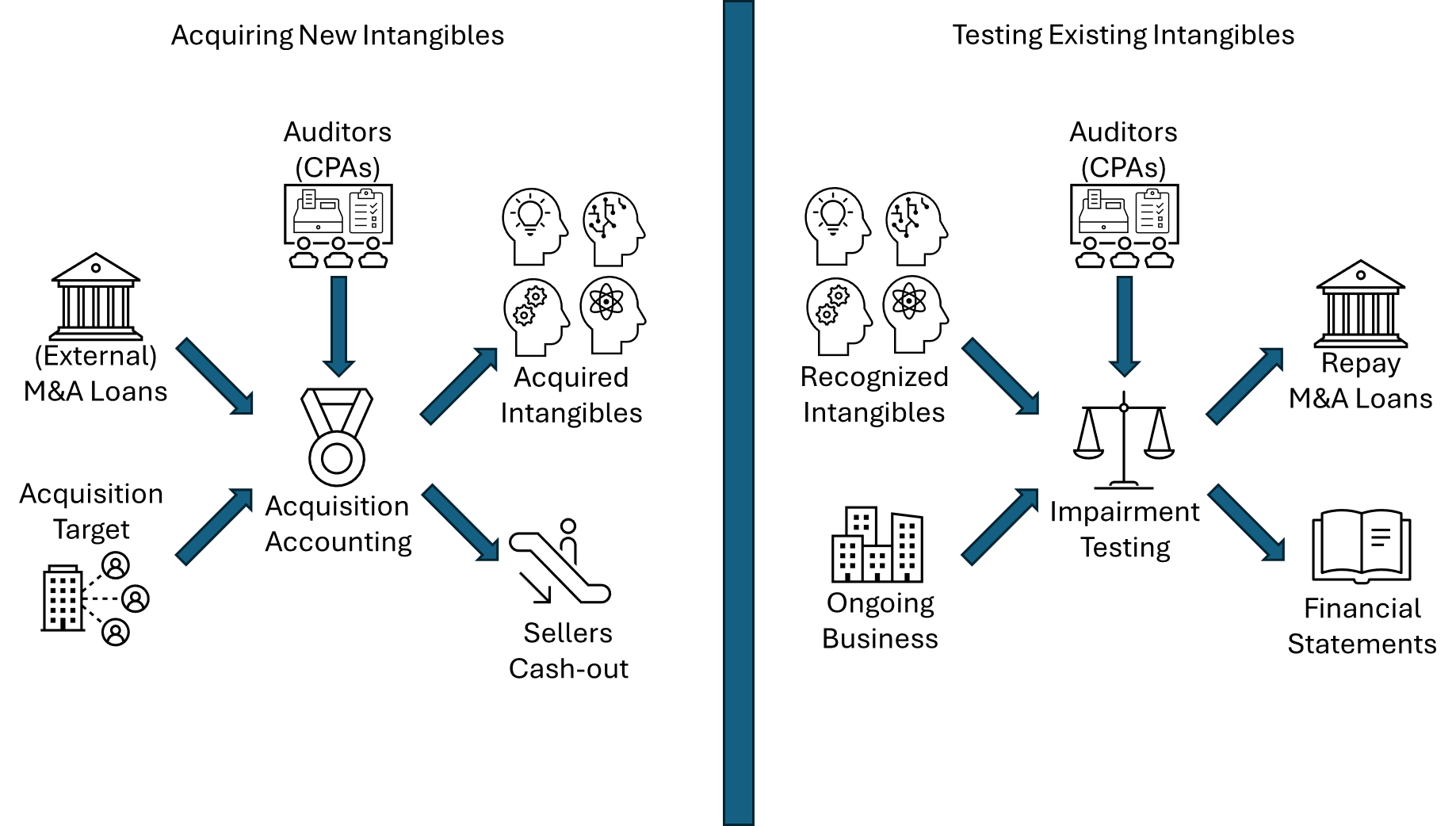

Required to report and update the fair value of intangibles for financial reporting? Concerned about auditor or activist investor push-back on methods and reasonable conclusions? Quid Valorem has experience helping private and public companies in the initial recognition and ongoing impairment valuation analyses of intangible assets for fair value financial reporting purposes. Contact Quid Valorem to learn more about our FV4FR Solutions.

Quid Valorem can prepare draft analyses, starting from limited scope estimated ranges of value just for planning purposes. After planning is done, Quid Valorem supports management’s fair value assertions with final, signed “comprehensive” reports with unrestricted scope opinions of value needed for financial reporting purposes. Contact Quid Valorem to learn more about our FV4FR Solutions.