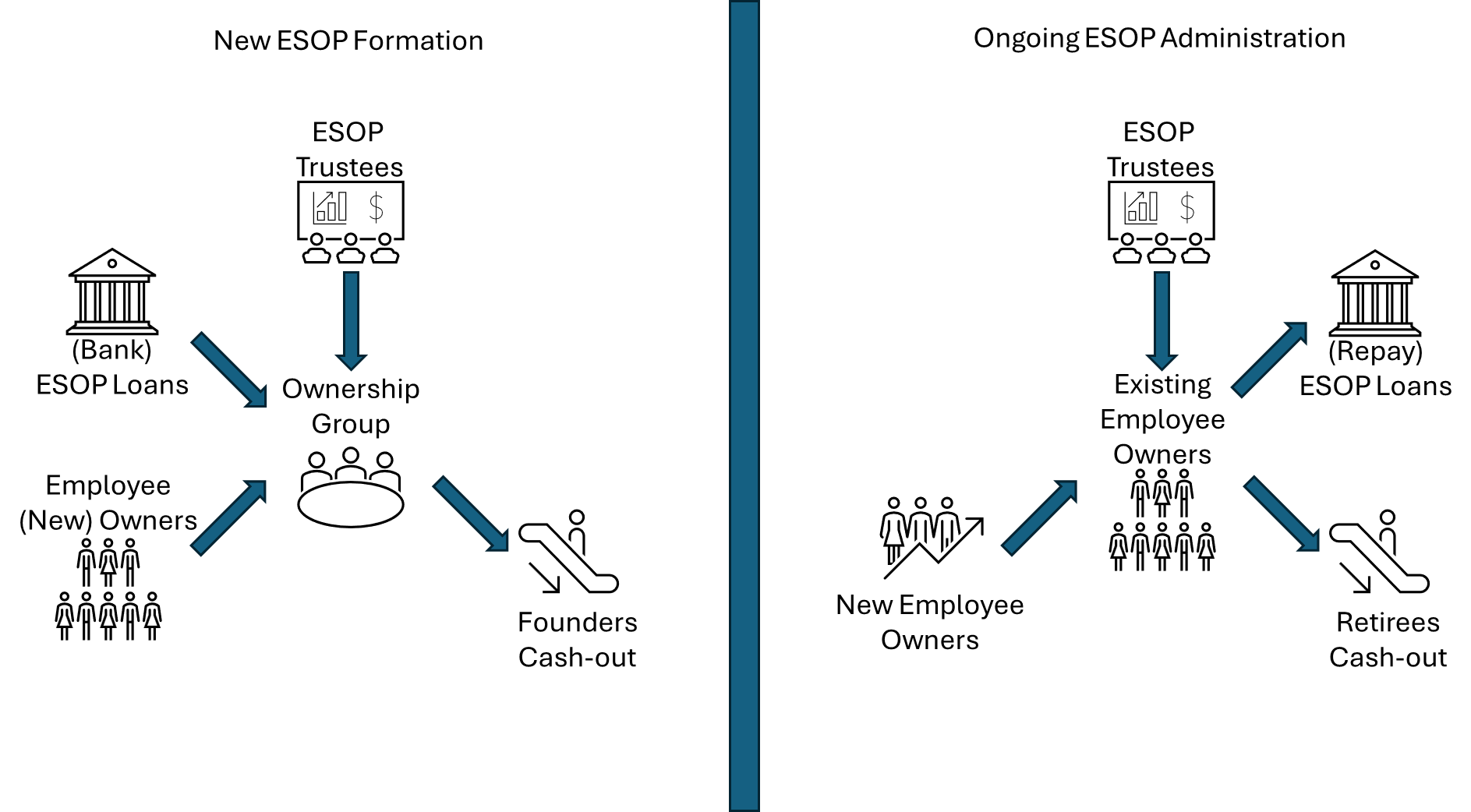

Concerned about scrutiny from the IRS, Department of Labor, or claims from dissatisfied employees? Administering a new or existing “young” ESOP and need a reliable, independent valuation of the Trust’s shares in the sponsoring company? Adjusting to repurchase liabilities for a more “mature” ESOP? Quid Valorem has substantial experience helping ESOP Trustees with fairness opinions for new ESOP formation and valuation analyses for ongoing ESOP administration. Contact Quid Valorem to learn more about our ESOP Solutions.

Quid Valorem can prepare draft analyses, starting from limited scope estimated ranges of value just for planning purposes. After planning is done, Quid Valorem supports the actual ESOP Trust with final, signed “comprehensive” reports with unrestricted scope opinions of value needed for ESOP origination and administration purposes. Contact Quid Valorem to learn more about our ESOP Solutions.